Get Tips For Better Tax Planning & Know Why ELSS-PPF Combination Is A Smart Tax Saving Option

- JWB Post

- December 15, 2015

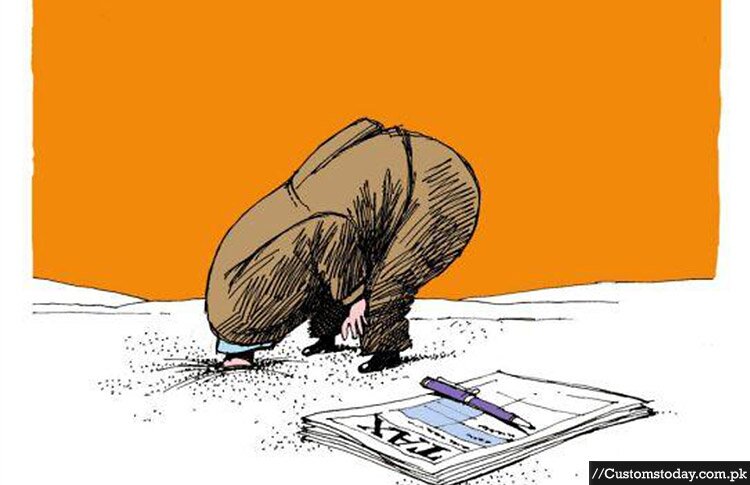

Two weeks from now, we would be entering the crucial January-February-March (JFM) months, the time when a large number of taxpayers rush to complete their investments that would lessen their tax burden for the current fiscal. Although ideally tax planning and tax-related investments should be done right from the beginning of the financial year, often people keep it pending for the major part of the year and rush in to invest when it becomes urgent during the last few months.

Financial planners and advisors suggest that two popular and easy to understand products that are also rewarding in the long term could be used to meet efficiently the obligations for tax-related investments that will lessen the tax burden on individual taxpayers. These are equity-linked savings schemes (ELSS) floated by mutual funds and the public provident fund (PPF), which is managed by the government. PPF has a 15-year lock-in from the year you start investing while ELSS has a three-year lock-in for each investment.

According to Kirit Shah of Kinjal Investment Consultancy in Surat, depending upon the age of the investor, he advises them to invest in ELSS and PPF in a sole ration. “If the taxpayer is a young individual, I suggest 30% of the investible corpus go into PPF and the balance 70% in ELSS. On the other hand, if the taxpayer is a 50-year-old individual, I suggest him to divide the total investment corpus equally,” Shah, who has been advising clients about investments for over two decades, said. “I usually follow the rule that says that the percentage of investment into equity should be 100 minus your age, and the balance of the debt,” he said.

The advantages of such a mix are manifold. For one, both offers tax advantages under the current taxation rules. Both the investments also help in building capital in the long run. In the long term, while the investment in PPF gives the stability to the portfolio, ELSS helps in the capital building. “This also helps in asset allocation in a very efficient manner,” he said. “And all the returns are tax-free in the long run,” Shah said.

According to Ketan Dalal of Babubhai Hiralal & Co in Surat, for every investment, even if done for the purpose of saving taxes, there should be a goal for which the investment is being made. In other words, tax saving itself should never be objective to invest. Dalal, who also advises his clients on investment related matters, prefers a combination of ELSS and PPF for saving taxes, although he believes that in the last few years, since the time government linked the rate of returns in PPF to 10-year government bonds, PPF has become slightly less lucrative investment than earlier.

“ELSS has given an average annual return of 15%, which is very good,” he said. “Even going forward, 15% CAGR (compounded annual growth rate) in ELSS is very much possible. On top of it, one could also enjoy the tax advantages,” he said. “In the long run, equity usually outperforms debt and so the three-year lock-in in ELSS for saving taxes is a blessing in disguise,” he said.

For Dalal, if someone is for the long term, ELSS should be the top priority. “If the investor is conservative and risk-averse in nature, then I would suggest him to invest more in PPF because unlike equities this is not a volatile investment,” he said.

According to fund industry officials, a systematic investment plan (SIP) in an ELSS can take care of investors’ need for regular and disciplined savings that also allows him/her the option to lessen their tax burden. Also, investing through ELSS also allows investors to build wealth over the long run and volatility, that is usually associated with equities, also reduces if one is willing to stay invested over the long run, that is 10, 15 or 20 years.

You can spend your whole life planning. But once you are ready, get out there and start doing it’: This proverb holds true for every aspect of our life including handling our tax planning.

All of us work hard to earn a living but we end up paying high taxes. It is imperative for us to be smarter with taxes too, which can help us make our dreams come true. Waiting till the last minute every year often drives us towards mere ’ tax saving’ rather than ’ tax planning’, which is not the correct strategy.

Tax planning takes into account one’s larger financial plan, which considers one’s age, financial goals, ability to take risk and the investment horizon. Hence, one should start the tax planning exercise well in advance by complementing it with his/her overall investment planning exercise.

Points to ponder

Here are some steps to remember while planning to save taxes:

Avoid last moment rush: The root cause of all mistakes lies in waiting till the eleventh hour to save taxes, which may result into forgetting or ignoring the facets of financial planning.

Buying insurance plans: Claiming deductions under Section 80C could often mean investing in a ULIP and being done with the tax headache. This way you could end up having 4-5 insurance policies with varying plans and clauses, most of which would be undecipherable and won’t serve your real needs. A single pure life policy covering 12-15 times your annual salary would work cheaper and serve the purpose.

Ignoring the power of compounding: People often forget about the power of compounding to his/her portfolio despite age, income, ability to take risks being on their side. If you want to increase or even meet your standard of living going forward, you need to beat inflation. For this, the role of equity as an asset class cannot be ignored in one’s tax saving portfolio. If the ideal composition is not maintained, your tax saving portfolio may give less than the optimum return.

Optimize tax saving options: Tax planning doesn’t start and end with Section 80C. The IT Act also allows deductions for your and/or your parent’s (sen- ior citizen) medical insurance premium, medical treatment, insurance of a handicapped dependant, donations to specified funds for specified causes, take loan for higher education and if one suffers from some specified diseases. Taking a home loan, investing in Rajiv Gandhi Equity Savings Scheme and National Pension Scheme can further reduce your taxable liability.

Restructure your salary: If you are a salaried person, chances are that you may oversee the various allowances that are allowed as exemption from your salary. These allowances could be HRA, transport allowance, medical allowance, food coupons, reimbursements on periodicals, telephone bills, uniform, fuel and maintenance of vehicle. Ensure that you diligently submit the bills for all your reimbursements and get extra bucks without the tax burden.

Timely declarations of tax-related investments: Employers deduct TDS every month from employees’ salary based on the projected tax liability. If you don’t declare your planned tax savings, the projected tax will be higher resulting in higher TDS. By the time you declare your tax-related investments fully, it may be too late as TDS is already deducted. Even if you declare all your tax saving options but avoid implementing it till the last quarter, you will have a substantial investing burden or a big tax cut. So, start early.

This article originally appeared here.

- 0

- 0